The thesis flips the innovation playbook: instead of building new products through legacy systems, change the infrastructure first. This case study examines through an Evidence-Based Management (EBM) lens what happens when teams operate on rebuilt technical foundations owned by their investor.

Cheap Capital Is Gone. Infrastructure Strategy Takes Over.

The $3.6 Trillion Problem

A decade of near-zero interest rates made even the laziest investment strategy look smart: raise, bet, wait, while leverage quietly covered the cracks.

Large funds, including a16z and Sequoia, could place thousands of bets and let cheap capital do the work.

That world is gone.

Interest rates have risen, and cheap capital is no longer there to mask the flaws.

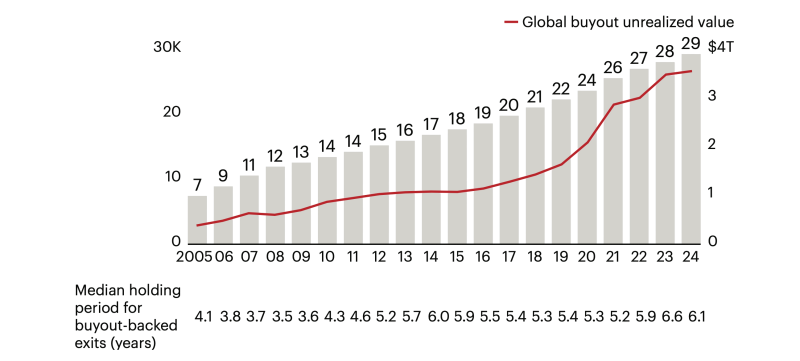

In 2024, private equity sits on 3.6 trillion dollars of unrealized value across roughly 29,000 unsold companies(1).

The buildup exceeds 2008 crisis levels.

At those levels, much of it cannot be sold without a loss.

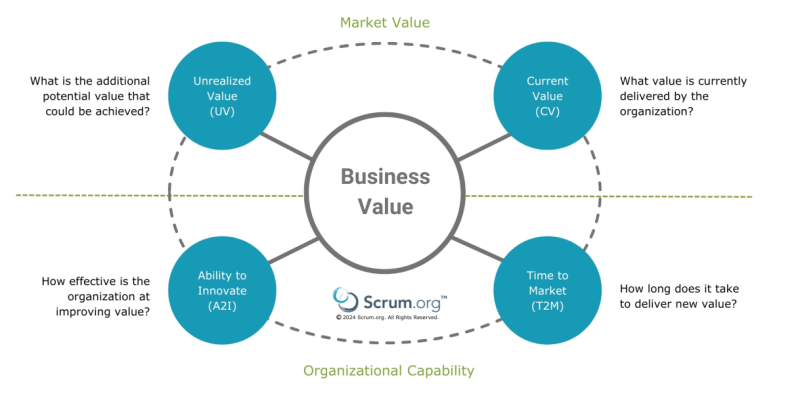

In Evidence-Based Management (EBM) terms(2), Unrealized Value (UV) remains high.Current Value (CV) does not.

Inversion Capital's Response

This high UV, low CV environment was where Inversion Capital made public its investment thesis:

1. Target commodity-like businesses with large user bases such as banks, telcos, and utilities.

2. Replace their legacy infrastructure with blockchain rails that operate faster and cheaper.

3. Repeat.

The thesis puts emphasis on the ability to change how work gets done. In EBM terms, this corresponds to focusing on the Ability to Innovate (A2I) first.

Large commodity companies typically prioritize CV: quarterly revenue, regulatory compliance scores, customer acquisition costs, at the expense of their room to maneuver when change is required.

How does protecting today kill tomorrow?

By making teams focus on what they can change today, work flows toward changes that quickly deliver visible value within existing constraints. Infrastructure improvements or large coordination initiatives that threaten current stability get deferred.

Over time, dependencies accumulate.

Technical debt piles up.

Most development effort goes toward maintaining what already works.

The team's Ability to Innovate steadily decreases.

This creates exactly the pattern Inversion targets: successful businesses constrained by the infrastructure they depend on.

Which raises the central question for any deep transformation strategy: how do you innovate when the foundation won't let you move?

Let's stress-test this thesis with a concrete example.

Stress-Testing the Thesis - A Hypothetical MVNO Acquisition

Inversion has stated studying the potential acquisition of an MVNO. I've spent years inside telcos building services for MVNOs.

Inside a Typical MVNO (Mobile Virtual Network Operator)

What you usually find is a small internal team, where each member manages one or more vendors.

Their main focus is around marketing and distribution as it's their only way to create differentiation.

Core operational services flow through external contracts they can hardly differentiate themselves on.

Network access.

Provisioning.

Billing.

Support.

Work flows through third parties.

Not through teams.

Having work flow externally constrains the team's Ability to Innovate.

Now imagine Inversion acquires this MVNO and implements their shared blockchain infrastructure. The dependency problem doesn't disappear. It just changes hands.

What happens when innovation depends on your investor?

Here’s what I’ve observed in a similar situation.

Pitfall #1 — The Infrastructure Owner's Dilemma

I managed back office projects at Opodo when our parent company Amadeus also provided our core reservation system.

Challenging that system internally quickly hit a wall.

Not because of the system's intrinsic qualities, but because its owner was also ours.

Decisions followed ownership, not data.

The conversation could not start.

The same pattern emerges with Inversion. Core operations get enforced by their smart contracts: provisioning, billing, settlement. Teams can optimize within those boundaries, but changing the boundaries requires going through their investor.

A2I stays with whoever controls the stack and writes the checks. But controlling infrastructure can generate another problem: it breaks the feedback loop.

Pitfall #2 — When the sound never comes

Imagine yourself sitting in front of a Steinway & Sons grand piano.

You press a key.

The sound comes a week later.

You press another one.

Another week.

You cannot adjust.

You cannot learn.

When Feedback Arrives Too Late

Long Time to Market (T2M) detaches learning from outcomes.

Let’s go back to the MVNO.

A competitor drops prices by 20%.

Or customers can't provision new lines during Black Friday.

Or enterprise clients have a new lucrative use case that can't be billed.

The fix lives in shared infrastructure managed by Inversion. And its timeline depends on Inversion's Product Backlog ordering.

Revenue opportunities slip away. Teams stay frozen.

Teams stop proposing changes they know will take months. The organization learns to avoid inspect and adapt. It avoids learning.

Pitfall #3: When Sparkling Wine Wins

The day after I joined Vivacances, I learned we were being acquired by Opodo.

A few weeks later, there was a celebration.

Music. Drinks. Speeches.

A developer leaned toward me and said:

“Champagne for the buyers. Sparkling wine for the acquired.”

20 years later, it still stays with me.

For the acquired team, proposing changes felt risky. Defending the status quo felt safe.

A2I inevitably suffers.

Everyone for Themselves

When teams lose authority over their technical stack, people tend to retreat into their job descriptions.

Ownership narrows.

Watermelon metrics(3) multiply.

Some topics fall outside anyone's role.

Teams end up optimizing for their local Current Value metrics while customer outcomes and the organization's Ability to Innovate become everyone's problem and nobody's job.

These pitfalls aren't inevitable. But avoiding them requires system thinking, not technological solutions.

What This Reveals About Your Next Transformation

Banks, telcos, and utilities have spent decades optimizing for Current Value at the expense of their Ability to Innovate. Today, they face competitive pressure from new agile disruptors.

Inversion Capital's thesis targets these traditional commodities to change them from the inside, developing Ability to Innovate in teams accustomed to risk-averse choices. The challenge is immense.

The patterns we observed (loss of product ownership, delayed feedback loops, disempowering cultures) aren't unique to infrastructure strategies. They emerge in any transformation that assumes behavioral change without systemic change.

Yet this analysis shouldn't overshadow two transformational realities often underestimated: the revolutionary efficiency gains possible with truly effective blockchain infrastructure, and the exponential impact of redesigning daily decision-making systems for team ownership.

The challenge becomes: how do you capture blockchain's infrastructure advantages while empowering the self-management capabilities that drive real agility?

For leaders attempting similar shifts: start with the systems that shape daily decisions. Technology amplifies whatever organizational dynamics already exist.

The patterns are predictable. The question is whether you'll spot them early in your own transformations.

- : Global Private Equity Report 2025 (Bain & Company)

- : Evidence-Based Management (EBM) is an empirical framework for maximizing value by making decisions based on evidence rather than opinion (scrum.org/ebm)

- : Watermelon metrics: Metrics that appear green (positive) on the surface but reveal red (problems) when examined deeper - like a watermelon.